SP500 LDN TRADING UPDATE 12/12/25

SP500 LDN TRADING UPDATE 12/12/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

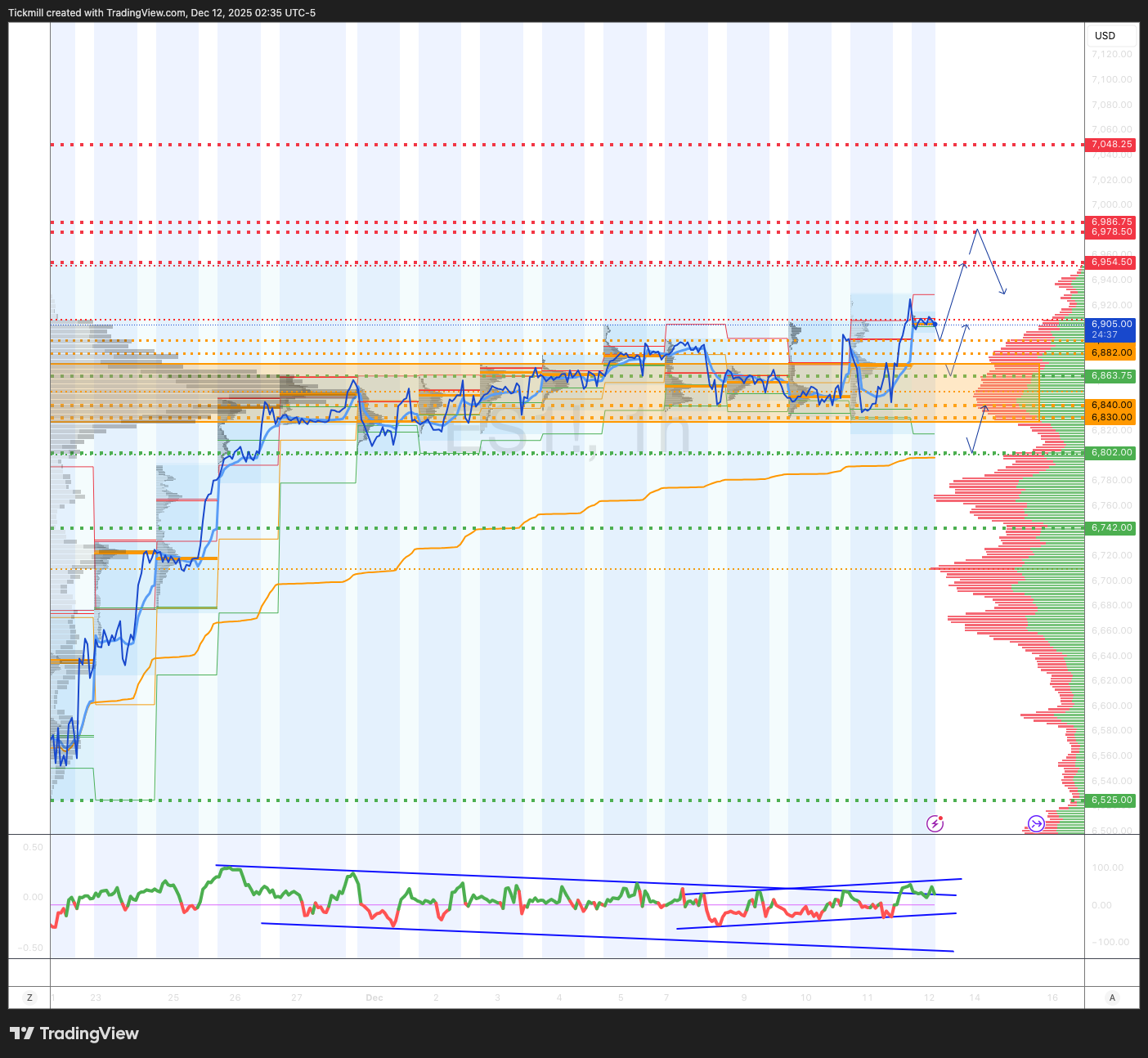

WEEKLY BULL BEAR ZONE 6830/40

WEEKLY RANGE RES 6978 SUP 6778

DEC EOM STRADDLE 6631/7067

DEC QOPEX STRADDLE 7025/6303

WEEKLY VWAP BEARISH 6747

MONTHLY VWAP BULLISH 6761

WEEKLY STRUCTURE – ONE TIME FRAMING HIGHER - 6812

MONTHLY STRUCTURE – BALANCE - 6952/6539

The SPX aggregate gamma flip point is 6780, whereas we are currently at a relative peak around 6950. This indicates that dealers are typically backing the price and will be applying brakes as it fluctuates up and down

DAILY STRUCTURE – BALANCE - 6909/6820

DAILY VWAP BULLISH 6882

DAILY BULL BEAR ZONE 6882/92

DAILY RANGE RES 6986 SUP 6863

2 SIGMA RES 7048 SUP 6802

VIX BULL BEAR ZONE 18.71

PUT/CALL RATIO 1.18

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TRAGET ATH>WEEKLY RANGE RES>DAILY RANGE RES

LONG ON TEST/REJECT DAILY RANGE SUP TARGET ATH>WEEKLY RANGE RES>DAILY RANGE RES

SHORT ON TEST/REJECT WEEKLY/DAILY RANGE RES TARGET 6930

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW

Markets are showing unease as the AI theme faces pressure, with ORCL down 13%, weighing heavily on AI leaders. GSTMTAIL dropped 345bps, while RTY gained 100bps, outperforming SPX (+5bps) and NDX (-70bps). Notably, NVDA (-325bps) and AVGO (-345bps) contributed to 50% of NDX's weakness.

What’s Performing Well?

- Mid-Income Consumer (GSXUMIDC): +132bps

- US Metals (GSXUMETL): +400bps

- Cyclicals ex Commodities (GSXUCYCL): +112bps

Cyclicals continue to outperform, signaling a rotation out of AI/tech. Top performers include:

- Travel & Leisure (GSXULSRE): +218bps

- Brick & Mortar Retail (GSXUBRCK): +173bps

- Most Shorted Staples (GSCBMSCS): +174bps

Cruise liners, previously lagging, are seeing a rebound despite Monday’s GIR report suggesting the street is overestimating net yield growth for 1H26 before recovery in 2H. RCL, which has been under-owned recently, is the standout performer today after announcing a $2B share buyback yesterday:

- RCL: +565bps

- CCL: +518bps

- NCLH: +561bps

- VIK: +140bps

FOMC Update:

The meeting proceeded as expected, with a 25bps reduction in the funds rate to 3.5-3.75%. Statements and Powell’s comments implied a higher threshold for further rate cuts. Fed staff estimates payroll growth is overstated by 60k jobs/month, compared to GS estimates of 30-35k. GIR anticipates two normalization cuts in March and June 2026, targeting a terminal rate of 3-3.25%.

ORCL Performance:

ORCL fell 13% due to disappointing performance and a sharp rise in off-balance-sheet CapEx. FY26 CapEx guidance was raised by $15bn to $50bn, which didn’t align with market sentiment, driving the stock lower.

Liquidity Trends:

ETFs accounted for 34% of market activity, influencing moves, with top-of-book liquidity at $8.66mm. Market breadth remains solid, with 377 SPX names trading in the green.

Current Flows:

- Overall activity levels at 4/10, slightly favoring buying.

- LOs skewed slightly toward selling, with notable supply in macro products, industrials, and info tech, while demand persists in healthcare, financials, and energy.

- Hedge funds are slightly better to buy, with demand in macro products, consumer discretionary, and communication services, offset by supply in financials, energy, and materials.

Cyclicals vs. Defensives (GSPUCYDE Index) has risen for 13 consecutive sessions, with the basket up 18bps today. The market is leaning toward a better growth outlook and increased consumer spending. The pro-cyclical rotation, which has been building for weeks, is becoming more evident as investors grow more comfortable with cyclical risk.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!